Tax and Bond Options for Raising Revenue to Solve Transportation Issues

During the past year, the Summit County Council has looked at various options for raising revenue to put toward solving transportation and traffic issues. During the upcoming week’s Summit County Council meeting Chief Civil Deputy Attorney Dave Thomas will present the various options available for raising revenues and how those specifically would be enacted.

There appears to be six options:

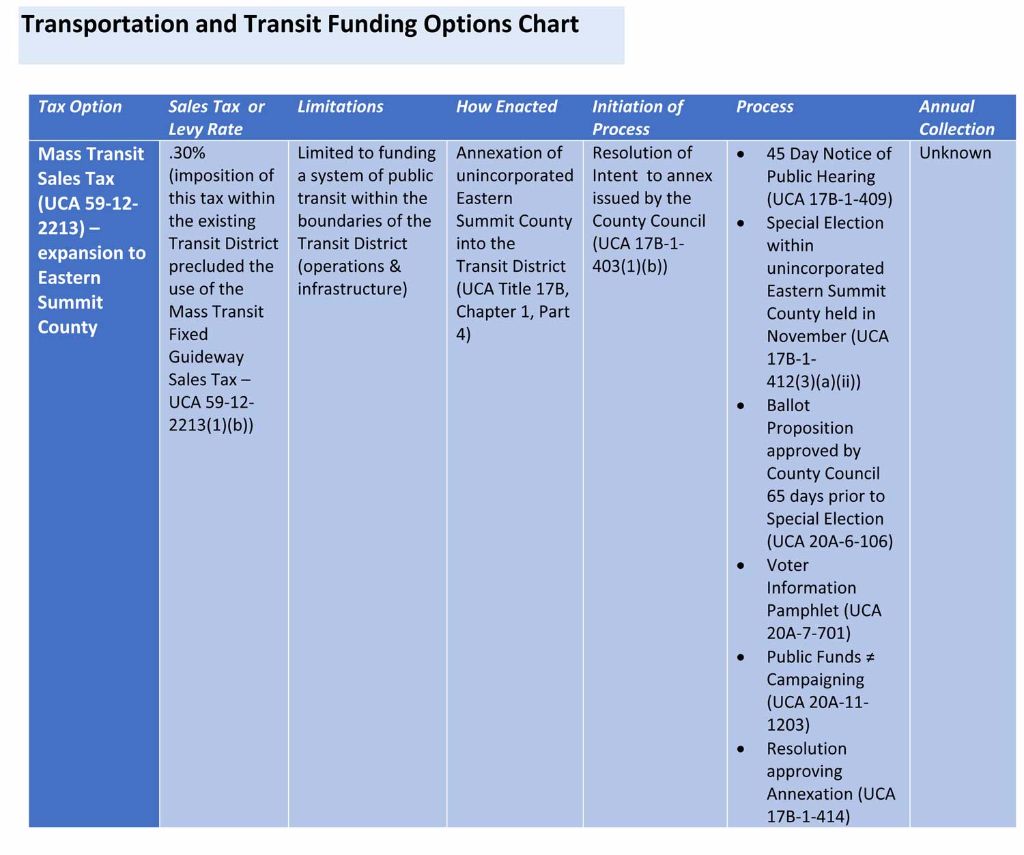

- Mass Transit Sales Tax expansion to Eastern Summit County.

- 0.3% increase in sales tax

- Limited to funding a system of public transit within the boundaries of the Transit District

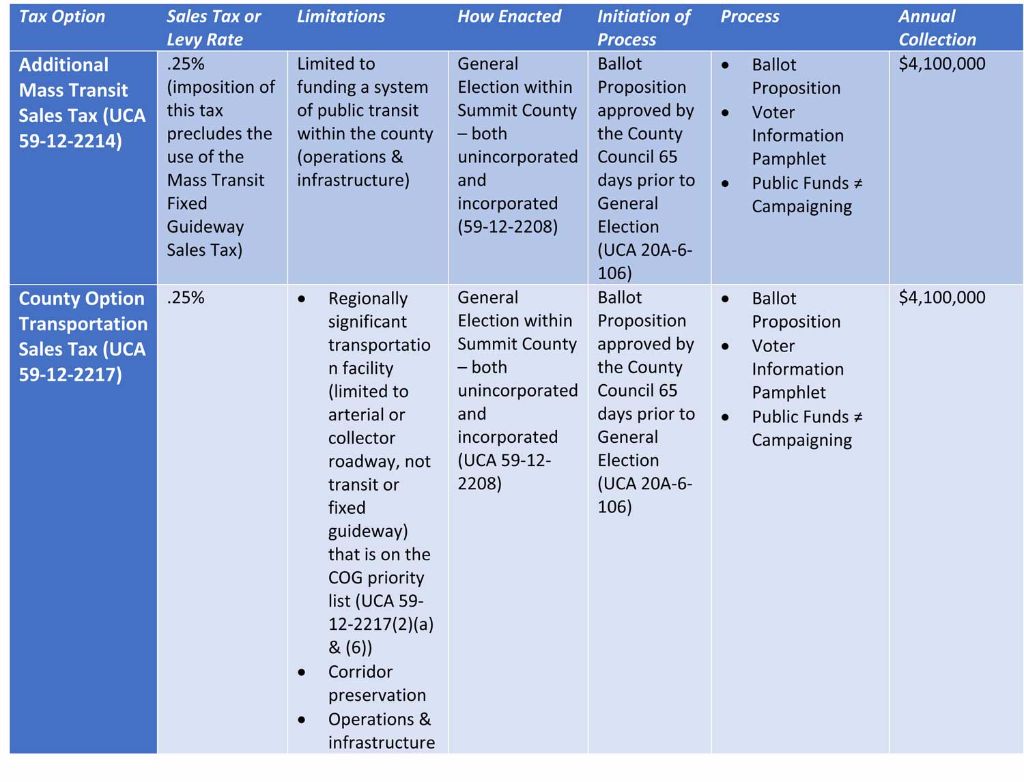

- Additional Mass Transit Sales Tax

- 0.25% increase in sales tax

- Limited to funding a system of public transit within the county

- County Option Transportation Sales Tax

- 0.25% increase in sales tax

- Can be used for regionally significant transportation facility, corridor preservation, operations, and infrastructure.

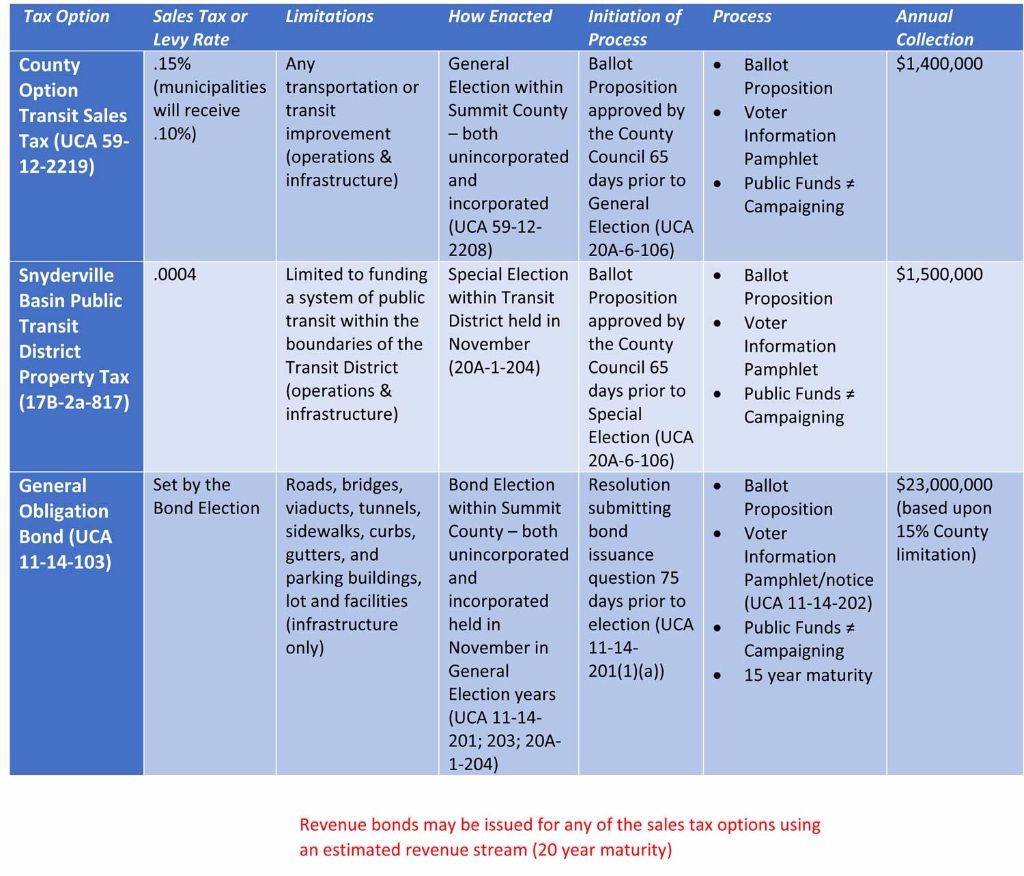

- County Option Transit Sales Tax

- 0.15% sales tax increase (municipalities will receive .10%)

- Can be used on any transportation or transit improvement (operations & infrastructure)

- Snyderville Basin Public Transit District Property Tax

- 0.0004 increase in property tax

- Limited to funding a system of public transit within the boundaries of the Transit District

- General Obligation Bond

- Tax increase is set by the bond election

- Can be used on roads, bridges, viaducts, tunnels, sidewalks, curbs, gutters, and parking buildings, lot and facilities (infrastructure only)

The options above, that have specific tax rates would bring in between $1.4 million to $4.5 million per year. If the county decided to create a general obligation bond, it could raise up to $23 million.

Many of these options require citizens to vote on them. Look for at least one of these options coming to your ballot in November 2016.

0 Comments

Comments

Leave a Comment