Cathy Clark Has Left Friends of Animals

We heard some unfortunate news today. It appears within the last couple of days Cathy Clark has resigned from Friends of Animal Utah. Cathy had been Director of Operations for a number of years.

We don’t know Cathy but the stories we’ve heard about her driving around northern Utah, picking out just the right animals that were not only likely to be adopted but good companions, sound amazing. According to people who know her, no one has done more for animals in and around Park City than she has.

We wish her the best in whatever direction she wants to take things.

Can Park City Be a Little Less Condescending Toward Summit County?

Throughout the debate of whether the Park City Film studio should be built at Quinn’s Junction that culminated in 2012, we continued to hear that Park City needed to annex film studio land into the city, so that the city’s development codes could be used. The implication was that Summit County would have somehow allowed a monstrosity to be built while Park City would use its strict design guidelines to help create the next Taj Mahal.

We thought we were done hearing that but yesterday’s Park Record quotes ex-Mayor Dana Williams about the Park City Film Studios and says Williams “supported the annexation of the land and the development of the studios there since that guaranteed the project was built in the Park City limits rather than in an unincorporated part of Summit County.”

If Park City representatives want to continue praising themselves for the Film Studio design that is fine. However, the hubris starts to show through the facade. People start to wake up.

Take a few citizen comments from a story about the studio at the Park Record:

“Just came back from a drive in Kamas and boy do I hope they have a budget for about 1000 trees. This thing is horrible looking. I really hope when completed it blends in a little.”

“Monumental white elephant. Future home of Woodward.”

“This idea reeked of disingenuousness from the beginning; now as I drive past that monstrosity on 248 or Hwy 40 I wonder what it will ultimately turn out to be…nothing that springs to mind seems very appealing. Chinese-owned film studio? Big Box store? Perhaps a second Fieldhouse is the best option, although it won’t stop the site from being a blight at the gateway to town.”

And those are some of the nicer quotes.

So the next time Park City says it wants to annex land so Summit County doesn’t somehow mess it up, keep the Film Studio in mind. I can’t fathom how it could be less attractive. While Summit County government isn’t blameless in the studio fiasco, at least The County Manager stated that the project was too big for the site. I think that’s something most unbiased people would agree upon.

Film Studio Timeline

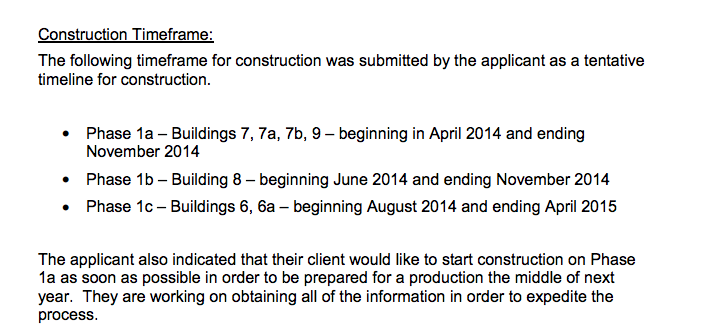

In case you were wondering what Park City Film Studios means when they say the project is “anticipated to remain on schedule,” we were doing research on the Film Studio and came across a “phasing timeline” which states when various elements of the Park City Film Studio are supposed to be done.

Interesting… As Game of Thrones often says, winter is coming.

This is from a December 5, 2013, City Council Meeting document:

More info on Park Rag… and Come Write With Us.

We’ve received some great feedback over the past few weeks and wanted to let you know about some changes at Park Rag.

First, if you want to know more about who we are, why we are doing this, what our history is, and what we are trying to accomplish please check out our About Park Rag page. We’ve updated it with more info.

Second, we want to hear from more voices in our community. That’s part of the definition of Citizen Journalism So, we’ve added a Write With Us section that will explain how you can start writing at Park Rag. Don’t worry if you’ve never written much. It is the essence of the ideas that are important. We definitely aren’t Grammar Stalins, so please let your lack of knowledge of dangling participles stop you. We sure haven’t.

Thanks again for checking out the Park Rag. We are really starting to feel like we can make a difference in Park City and that’s because of you.

Why the Game Lemonade Stand Still Makes Me Wonder Who Will Get Screwed on Vail Sales Tax Revenues

Remember the old computer game Lemonade Stand? Nostalgia. Now, let’s use that to demonstrate why there still isn’t a good explanation of how Epic Pass taxes will be divvied up between Summit County and Park City.

In Lemonade Stand, you make choices about prices and marketing to achieve success in the sugar-water business. Let’s complicate it by adding sales tax to it. We’ll start with you owning one lemonade stand in Lemonsville. Lemonsville has a 5% sales tax. You decide to make it easy on your customers and sell your lemonade for $1. You’ll simply subtract the tax out of the total. Sally comes up to buy a $1 glass of lemonade, pays $1.00, and about 5 cents of that is sales tax. The state will take their share of the 5 cents and Lemonsville gets the rest.

Your lemonade stand is doing great but you decide to take it into the 21st century sell an “all-you-can-drink” pass from your stand for $100. Sally loves the idea and comes and buys a pass from your stand. She pays $100.00, and about $5 of that is tax. The state takes their share and Lemonsville gets the rest.

Darn, your family has to move out of state. You are moving to Sugartown but you want to keep your lemonade stand open. So, you make a website to sell your passes and hire some of your classmates back in Lemonsville to run it. Passes are still $100 and Chip from Lemonsville buys the first one. He pays $100.00. The tax is still $5 because although your website is physically out of state in Sugartown, your lemonade stand is still in Lemonsville. That $5 goes to the state, they take their share, and Lemonsville gets the rest.

You are now rolling in the dough and decide to expand by buying someone else’s limeade stand in the neighboring town Lime City. Now you have a lemonade stand in Lemonsville, a limeade stand in Lime City, and you live in a completely other state. How are you going to maximize your profit? You decide to offer your “all-you-can-drink-pass” for $100 and make it work both for lemonade and limeade at your two stands.

Your accountant decides he better call you. He tells you that while Lemonsville’s sales tax is 5%, Lime City’s sales tax rate is 10%. So, you better account for it correctly. You say no problem. If someone buys a pass at my lemonade stand I’ll charge them 5% and if they buy the pass at my limeade stand, I’ll charge them 10% sales tax. Your accountant asks what rate you’ll charge if someone buys it online. You pause and say…uh…uh….

“I’ll divide that out based on which stand they use the pass at each time.” Your accountant replies, “how do you know how many times this year they are going to stop at your stand?” He continues, “so if they come once in June, what are you going to send to the state on June 30? All of it?” You reply “no”. “I’ll send some in July and the rest in August.” The accountant then says “what if that person never comes back in July? How much will you send?”

So, you ask your accountant what to do. He reminds you that you have included tax in your pass price and Lime City taxes costs more. He says it would be financially smart to find a way to make more taxes come through Lemonsville. He says you’ll make $5 more on every pass sold through Lemonsville. You think and think and think about a way to make it defensible to have Lemonsville taxes be collected a majority of the time. You decide to collect tax at the first place the pass is used. Your lemonade stand is bigger, opens earlier, and has more customers than your limeade stand. You might not save every penny but at least you’ll make more! And indeed you do.

Lime City is not happy but what can they do? Their sales tax revenues are down and they don’t have as much money as when the limeade stand was run locally. They talk to their accountant. He says “maybe you should have written to the State Tax Commission and got a ruling before this all started”. They say, “seriously, what should we do now?”. He responds, “Well, I guess you could raise taxes”.

Park City is Paying 60% Commission on Ad Sales at The Ice Rink?

If you’re a local real estate agent your commission is probably 1%-2% of your next transaction. If you sell cars, you’ll probably get 25%-30% of the profit on your next sale. If you are doing general sales work, pounding the pavement, you’ll likely receive 30%-40% commission on your next deal. If you have the contract for ad sales at the Park City Ice rink, your commission rate makes those look like chump change.

On Thursday, the Park City City Council will be voting on renewing a contract for the sale of advertising space and program sponsorships at the Park City Ice Arena. Matthew Senske, a former Ice Arena employee, was awarded the contract in late 2012. His company, Senske LLC, signed the contract in April 2013. Senske was required, and met, a target of $20,000 in sales during the first 6 months. It is also likely Senske will meet his 18 month target in October 2014. What will Senske LLC make on each sale of ads or sponsorships at the rink? 60%.

According to documents created by the Ice Rink, Senske LLC has sold about $56,240 of ads through August. The company needs to sell an additional $3,760 this month to hit the goal of $60,000 of sales in 18 months.

By all measures, it seems like Senske LLC has done a decent job. It also appears like there weren’t many proposals to initially choose from in 2012. Finally, it also seems like Senske LLC is the type of company Park City would like to support, with a US bob sledder at its helm.

However, these are also public funds at play. The Ice Rink is poised to expand with approximately $2.5 million more in funds if a bond initiative passes in November. This means each Summit County home owner and business will pay more in property taxes. If that’s the case, we as citizens need to demand that our money is being used wisely.

While perhaps in 2012, with few takers, the Ice Rink had to pay 60% commissions in order to find anyone who would be willing to sell their advertising. However, it is now two years later. The economy has improved and businesses are looking to expand. To be frank, a 60% commission seems absurd. It would be shocking if there wasn’t a qualified person or company that would take this on for a 40% commission and still meet the goals. Due to local ties, we would hope that company is Senske LLC. If not, we aren’t excited about the city throwing money away, especially when more is being asked from their citizens already.

Thanks!

Just wanted to thank the person who just helped with the “Submit A Tip Page”. We really appreciate the feedback.

This Week’s Summit County Manager’s Report (one of the best sources of info of what’s happening in Summit County government).

The Summit County Manager’s Report is published every 1-2 weeks and tells you what your Summit County government departments are working on. It includes information about everything from planning applications to legal matters. There is usually something interesting included.

Are Park City’s kids college ready? Better than most but not perfect.

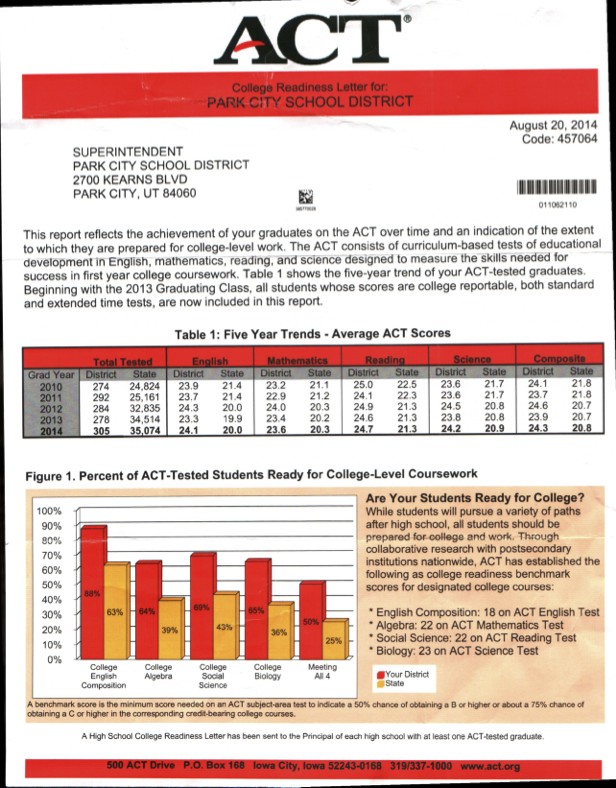

The Park City School District published the 2014 College Readiness Letter from ACT, an organization that provides a standardized test used by many colleges as a factor in admittance. The really encouraging news is that Park City students were about 25% more prepared for college classwork than their counterparts in other Utah schools. The results varied from 88% of students being college ready in English Composition to 64% being ready in Algebra.

The results get a little more concerning when ACT combined all 4 major areas to determine readiness. In that case 50% of Park City students are college ready in the 4 major areas of english, math, social science, and biology. That’s still far above the state average of 25%.

So relatively speaking, Park City is preparing its students for college. However, about half of all students appear to need to up their game in at least one area once they arrive at university.